For small business owners, keeping accurate financial records can be the difference between staying organized and feeling overwhelmed at tax time. A general ledger is one of the most essential tools for tracking your business’s financial health — yet many entrepreneurs overlook it until issues occur. Whether you’re a freelancer, startup founder, or growing small business owner, maintaining a clear and consistent ledger provides a single source of truth for every transaction that affects your business.

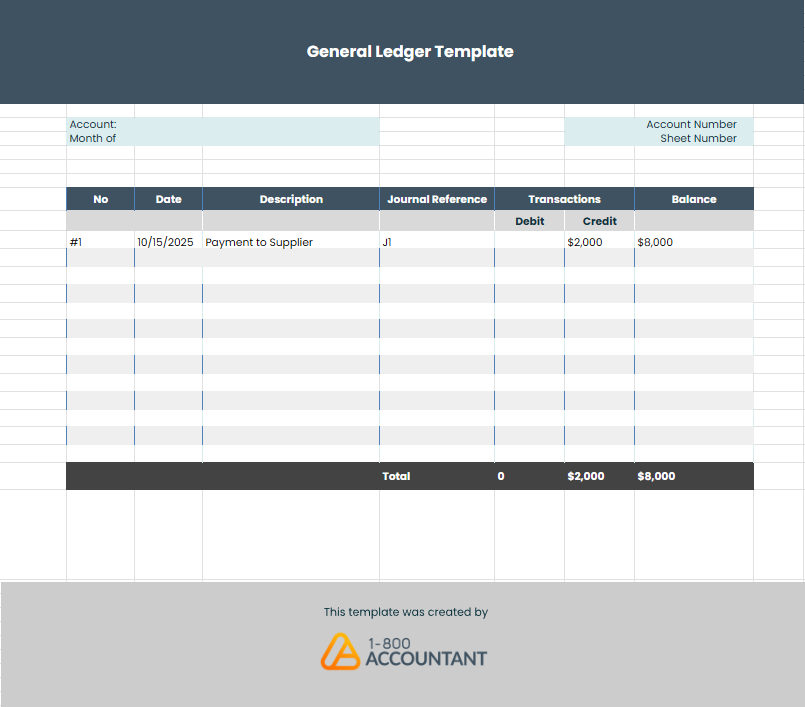

To help you get started, 1-800Accountant, America's leading virtual accounting firm, has created a free downloadable general ledger template that simplifies your bookkeeping and enables you to stay compliant throughout the year. Below, we’ll explain why the ledger is critical, what it includes, how to use a general ledger template, and when it might be time to upgrade to a more advanced system.

Download your free general ledger template

Why a General Ledger Is Critical for Small Businesses

A general ledger is the master record of all your business’s financial transactions. Maintaining a general ledger for startups and more established companies is critical. Every dollar earned or spent — from sales revenue to payroll expenses — flows through it. In double-entry accounting, transactions are first recorded in journals, like your sales or expense journal, and then summarized in the small business general ledger, which feeds directly into your trial balance and financial statements.

A well-maintained ledger offers multiple benefits:

Accuracy: Reduces errors in financial reporting by ensuring every transaction is accounted for.

Audit trail: Provides documentation for every entry, making it easier to track discrepancies.

Tax support: Simplifies year-end reporting and ensures you don’t miss valuable tax deductions.

Decision-making: Helps you monitor profitability, expenses, and cash flow trends.

Neglecting your accounting ledger can lead to messy books, missed tax deductions, or late filings — issues that cost time and money and cause distractions. A consistent ledger system keeps you organized and confident when it matters most.

Anatomy of a General Ledger: Components and Structure

Your general ledger organizes financial data by account type, following a chart of accounts that groups transactions into five main categories:

Account Type | Examples |

Assets | Cash, Accounts Receivable, Equipment |

Liabilities | Accounts Payable, Credit Card Debt |

Equity | Owner’s Capital, Retained Earnings |

Revenue | Sales, Service Income |

Expenses | Rent, Utilities, Office Supplies |

Each account includes several key fields:

Date – When the transaction occurred

Description – A brief explanation (e.g., “Client invoice #102”)

Reference – Invoice number or job code

Debit and Credit – The amounts recorded to each side of the transaction

Running Balance – Updated total after each entry

For example, when your business makes a $500 sale, you would debit Cash and credit Sales Revenue. If you later pay $200 in office supplies, you would debit Office Supplies Expense and credit Cash. These entries flow through your ledger and form the foundation for accurate financial statements.

How to Use the Downloadable General Ledger Template

Our free template is designed for use in Microsoft Excel or Google Sheets and includes pre-labeled columns for account name, date, description, debit, credit, and account balance.

Download your free general ledger template

Step-by-Step Setup

Customize your chart of accounts: Rename or add accounts to fit your business (e.g., “Client Income” or “Software Subscriptions”).

Assign account numbers: Use simple numbering (e.g., 1000s for assets, 2000s for liabilities) for easier organization.

Enter transactions: Record each financial event, noting whether it’s a debit or credit.

Check your balance: After each entry, confirm the running total matches your bank or payment records.

Add notes: Include job codes or comments to clarify unusual transactions.

Tips for Accuracy

Record entries promptly to avoid gaps.

Always double-check debit and credit placement.

Reconcile totals with your bank statements each month.

Protect your sheet with a password or back it up to a secure cloud storage service.

Best Practices and Maintenance Tips

A general ledger is only as good as the consistency of its updates. To keep your books clean:

Stay consistent: Use the same naming conventions and numbering for all accounts.

Reconcile regularly: Compare your ledger with bank and credit card statements at least monthly.

Automate when possible: Accounting software can reduce manual data entry and human error.

Run monthly reviews: Review for anomalies and ensure your trial balance aligns.

Avoid common pitfalls: Missing entries, misclassified expenses, and rounding errors can create significant issues later.

When in doubt, reach out to a professional. Our tax-deductible, full-service bookkeeping solution, backed by a designated bookkeeper, can help review and maintain your records accurately year-round.

Using Your Ledger to Generate Reports and Insights

Once your transactions are entered, your ledger becomes a powerful analysis tool. With your ledger, you can:

Create financial statements: Use totals to prepare your profit and loss statement and balance sheet.

Monitor cash flow: Identify trends in spending or income fluctuations.

Prepare for tax season: A complete ledger makes it easy to file accurate returns and claim all eligible deductions.

Spot performance trends: Compare current results with prior months or years.

Your ledger isn’t just for compliance purposes — it’s a roadmap to smarter business decisions. If you’re unsure how to interpret your reports or where to go next, consider scheduling a free 30-minute consultation with 1-800Accountant to get started.

When and How to Scale Beyond a Spreadsheet

While our free template is an excellent starting point, you may outgrow it as your business expands. Signs you’re ready for more advanced bookkeeping tools include:

High transaction volume or multiple revenue streams

Multi-location or multi-currency operations

Need for real-time reporting or payroll integration

Inventory tracking or invoicing complexities

At this stage, transitioning to accounting software or outsourcing bookkeeping can save time and improve the accuracy of your ledger. 1-800Accountant offers full-service bookkeeping and accounting solutions designed to scale with your business, and a good ledger eases that transition.

Final Thoughts & Call to Action

A clean, accurate ledger is essential to your small business operations. We hope you will download your free general ledger template and reach out to us when you're ready for professional bookkeeping support.

In the meantime, please review our other free materials, including our chart of accounts template, bookkeeping checklist, and financial statement guide.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. 1-800Accountant assumes no liability for actions taken in reliance upon the information contained herein.