For small business owners and independent contractors, getting paid on time can make or break cash flow. Yet many service-based professionals lose income or risk damaging client relationships due to unclear or incomplete invoices. Missing details, inconsistent billing formats, or vague payment terms can all lead to delays and disputes, ultimately straining your operations.

Take the first step to streamlining your billing process with this free downloadable contracting invoice template explicitly designed for small businesses, freelancers, and contractors, courtesy of 1-800Accountant, America's leading virtual accounting firm. Using it will save time, improve professionalism, and ensure your records stay clean and ready for tax and bookkeeping purposes.

Download your free Contracting Invoice Template here

What Is a Contracting Invoice? (vs. Other Invoices)

A contracting invoice is a billing document used by contractors, freelancers, and service-based businesses to request payment for work performed and services provided to customers. Unlike product-based invoices, these emphasize labor, services rendered, and project materials rather than physical goods.

Typical examples include invoices from construction professionals, subcontractors, web developers, electrical contractors, consultants, or creative freelancers who bill per project or by milestone.

Key differences from other invoices:

Sales invoice: Focuses on the sale of tangible goods.

Consulting invoice: Often emphasizes hourly consulting time only.

Retainer invoice: Bills clients in advance for ongoing access to services.

A contracting invoice also plays a critical role in your tax documentation and compliance — serving as proof of income for reporting and deductions. Maintaining detailed invoices supports accurate bookkeeping and simplifies end-of-year tax preparation.

Key Elements Every Contracting Invoice Template Should Include

A well-structured invoice ensures clarity and reduces confusion for your clients. Here are the key elements your contracting invoice should contain, achievable via our freelancer invoice template.

Business and Client Details

Your business information: Name, address, phone number, email, and relevant license or registration numbers.

Client details: Their company name, contact person, address, and email.

Branding: Include your logo and consistent brand styling for professionalism.

Invoice Identifiers and Dates

A unique invoice number (e.g., “Invoice-001”).

Issue date and service dates to clarify when work was performed.

Due date and payment terms (for example, “Net 30”).

Setting clear identifiers helps you organize records and prevent duplication or missed payments.

Itemized Work Description and Costs

Each task or service should be listed as a separate line item with descriptions, rates, quantities, and totals.

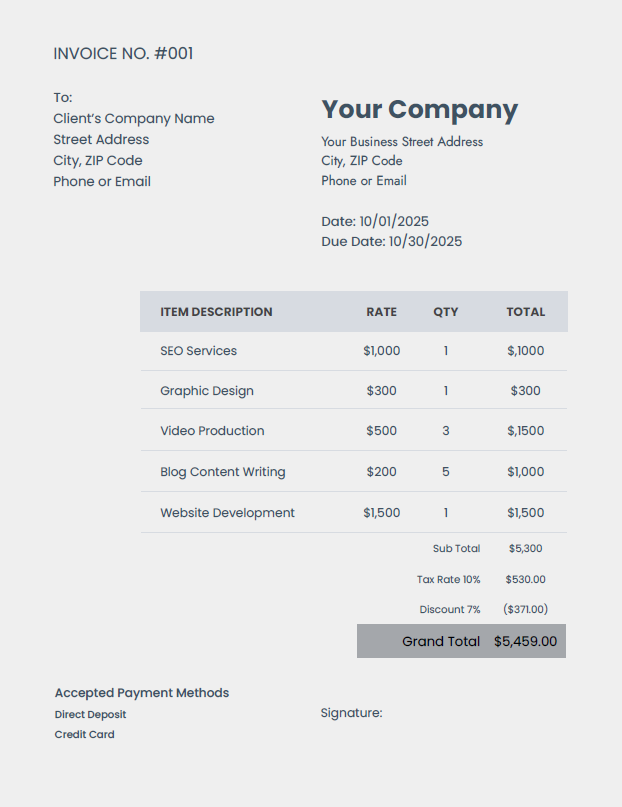

Example from the free invoice template:

Item Description | Rate | Qty | Total |

SEO Services | $1,000 | 1 | $1,000 |

Website Development | $1,500 | 1 | $1,500 |

Graphic Design | $300 | 1 | $300 |

Always include subtotals, taxes, and discounts if applicable. Transparent itemization helps your client understand the value of each charge.

Payment Terms and Instructions

Provide accepted payment methods — bank transfer, credit card, or direct deposit — and specify routing details. Include your late fee policy or early payment discount in your customizable invoice template.

For example:

“Payment is due within 30 days of the invoice date. Late payments are subject to a 2% monthly interest charge.”

Clear payment instructions help avoid misunderstandings and encourage prompt settlement.

Additional Sections and Optional Add-Ons

Terms and conditions: Reference the contract or project agreement.

Retainage or holdback: For contractors in construction or similar industries.

Notes or disclaimers: Add remarks such as “Please contact us within 7 days for any discrepancies.”

Attachments: Include supporting materials like receipts or progress photos.

How to Use and Customize the Downloadable Contractor Billing Template

Our free contracting invoice template is available as a .docx file, so that you can easily import and edit it into common editors like Microsoft Word and Google Docs.

Steps to Use:

Download the file and open it in your preferred program.

Customize with your logo, color scheme, and fonts to match your brand identity.

Update the business, client, and item fields with accurate details.

Use a logical file-naming system, such as “Invoice-ClientName-Date,” to stay organized.

Save each invoice as a locked PDF before sending for a professional look.

You can easily adjust columns to accommodate hourly rates, materials, or flat-fee projects. Consistency builds client confidence and makes bookkeeping tracking easier.

Download your free Contractor Invoice Template here

Best Practices for Contractor Invoicing

Efficient invoicing isn’t just about the document — it’s about how and when you send it.

Send Invoice Promptly

Send invoices immediately after completing a project or milestone. Waiting weeks can delay payments and confuse clients. Prompt billing improves cash flow — a vital aspect of keeping your business healthy.

Clear Communication and Transparency

Before starting a project, align with your clients on

Scope

Pricing

Payment terms

Attach receipts or project summaries to validate charges. Transparent communication fosters trust and reduces billing disputes.

Invoice Follow-Up and Tracking

Maintain a simple tracking sheet or use software to record invoices:

Sent

Paid

Overdue

Regular follow-ups demonstrate professionalism and help to prevent overlooked payments. Track “days sales outstanding” to measure how quickly you collect cash after billing.

If you’re managing multiple clients, 1-800Accountant’s tax-deductible full-service bookkeeping solution can help automate invoice tracking and reconcile payments for tax time and throughout the year.

Avoid Common Invoicing Mistakes

Common invoicing errors that you should make every effort to avoid include:

Forgetting to include all line items or tax amounts.

Failing to specify payment terms.

Using inconsistent or non-unique invoice numbers.

Omitting due dates or late-fee terms.

Double-check every invoice before sending it to avoid payment delays.

When to Move Beyond a Professional Invoice Template

As your business grows, you will likely need to transition from manual templates to automated invoicing software or to professional support. Platforms can:

Integrate with accounting tools.

Send reminders.

Manage recurring invoices.

At that stage, partnering with a professional service built for small businesses like 1-800Accountant can save time and ensure your invoicing ties directly to your bookkeeping and tax compliance workflows.

Sample Walkthrough

Here’s how the 1-800Accountant small business invoice template for contractors looks when completed:

Example Scenario:

Business: Apex Creative Solutions

Client: Brightview Marketing

Services: SEO, Video Production, and Web Design

Subtotal: $5,300

Tax (10%): $530

Discount (7%): ($371)

Grand Total: $5,459

Accepted Payment Methods: Direct Deposit or Credit Card

Due Date: November 15, 2025

This sample mirrors the structure of the downloadable invoice and can be adjusted for any type of project — from construction to creative services.

Next Steps for Invoicing

A clear, professional contracting invoice template helps you get paid faster, stay organized, and simplify bookkeeping responsibilities. It also serves as the foundation for accurate cash flow tracking — a crucial factor in sustaining business growth.

Download your free invoice template today to start standardizing your billing process. For expert help managing invoicing, bookkeeping, or taxes, schedule a free 30-minute consultation with 1-800Accountant for personalized support tailored to your distinct business needs.

Understanding cash flow helps lenders assess your liquidity and ability to repay. With the right systems in place, you can confidently manage both invoicing and financial planning.

FAQ / Additional Considerations

What if my client requests a different invoice layout?

Fulfill your client's invoice request by adjusting the free template’s columns or colors to fit client preferences — just keep essential data like invoice number, dates, and totals visible.

How do I handle deposits or partial payments?

Handling deposits or partial payments is relatively straightforward. Include separate line items for deposits received or balance due. Then update the invoice after each payment for transparency.

Do contractors need to charge sales tax?

Whether contractors need to charge sales tax depends on your state and the nature of your service. Check local tax rules or consult an accountant for clarity on this front.

Are invoices legally binding?

An invoice alone isn’t a contract or legally binding, but it documents agreed-upon terms and can serve as supporting evidence in disputes.

How long should I keep invoice records?

Retain digital or paper copies for at least seven years for audit and tax purposes. Organized recordkeeping also makes filing easier each April.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. 1-800Accountant assumes no liability for actions taken in reliance upon the information contained herein.